President Trump wants the pending tax bill to be called the “Cut, Cut, Cut” Act, but it’s better described as “The Betsy DeVos Tax Cut” Act.

At its heart, this tax plan is a giant giveaway to the super wealthy coupled with a cut in support for public schools and other services on which middle class and low-income families rely. Because a deficit blowing $1.5 trillion tax cut for corporations and billionaires like Betsy DeVos isn’t enough for Congressional Republicans, they’ve got to come up with additional offsets. One of the biggest on their list is ending the ability of middle class families to deduct state and local income and sales taxes that fund public schools.

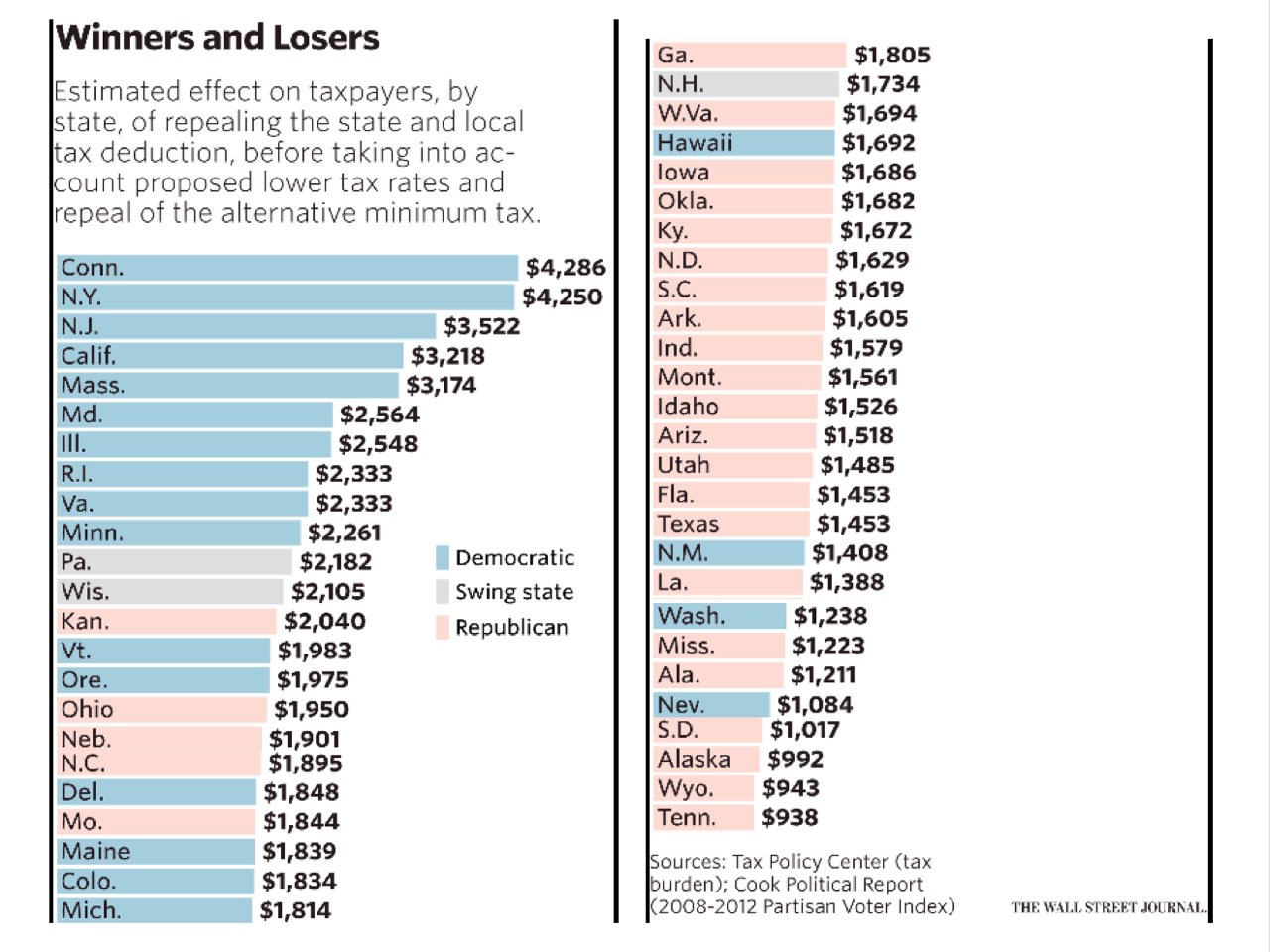

According to the Department of Treasury, the state and local tax deduction is worth approximately $1.3 trillion over a ten-year period. An estimated $783 billion stems from state income and state sales tax deductions. Some $486 billion stems from property tax deductions. Undoubtedly part of the reason the state and local tax deduction is in the crosshairs of Republican tax cutters is because it’s large and benefits ‘blue’ states more than ‘red.’

But the state and local tax deduction essentially pays for a large chunk of public education. Federal tax expenditures are the functional equivalent of direct federal spending. The government can provide an individual a direct grant to buy education services, for example, or it can provide an indirect deduction or tax credit for education services bought. The effect is the same.

Think about someone in the 28 percent tax bracket that pays $20,000 in state income and local property taxes each year. About half of that money goes to public schools either as a percentage of subsequent state budget outlays or passed through directly to schools from local governments and local school tax authorities. Ok. Consider the portion for public education, the $10,000 half.

When an individual in the 28 percent marginal tax bracket itemizes and deducts $10,000 worth of state income and local property taxes for schools, he or she reduces his or her federal tax bill by $2,800 ($10,000 * .28 = $2,800). Thus of the $10,000 that goes to pay for public education, the individual pays $7,200 and the federal government pays $2,800. In other words, the federal deduction makes using state and local taxes to fund education and other public goods or services more attractive, because it makes state and local taxes a cheaper source of revenue for regular people than they otherwise would be.

Eliminating the state and local tax deduction (SALT) would devastate the ability of state and local governments to raise funds for local schools. It would make current state and local taxes more expensive for regular taxpayers inevitably leading the conservative American Legislative Exchange Council (ALEC) and others later to call for reductions in state taxes to make up for the federal ‘tax increase’ — thus further starving public education. In other words, eliminating or significantly curbing SALT is the beginning of a cycle of disinvestment from public education.

Now Congressional Republicans want to call their SALT changes a compromise because they would retain a federal deduction for property taxes (capped), but about 2/3rds of the current SALT deduction is for state income and state sales taxes (p 33). A little over one-third of state budgets go to fund public education. Elimination of the state and local income and sales tax deduction, the so-called House Republican compromise, would whack about $250-$300 billion in support for public education over the next ten years. That’s like eliminating the Title I program and IDEA special education program overnight.

The House Republican tax plan shouldn’t be called the “Cut, Cut, Cut” act. It should be called “The Betsy DeVos Tax Cut” act. It’s a huge giveaway to the super wealthy of public resources that simultaneously works to starve public education.

This isn’t a ‘blue’ state v. ‘red’ state issue. This is an issue of do you support public schools or don’t you.