What if you knew your child could go to college from the moment your baby is born? That after 18 years, the financial and educational investments that you and your child make from birth will guarantee financial support to go to college? And what if this guarantee were available to every child and every family, regardless of that child or family’s academic qualifications or economic backgrounds?

That’s a pretty bold promise to make, but is the promise that stands behind the grand vision of the newly launched “Oakland Promise.” Its cradle-to-career approach is unique – most promise programs typically don’t start until high school. It also integrates comprehensive financial and non-financial assistance at key stages in a student’s academic lifetime:

- Brilliant Baby: Every baby born into poverty in Oakland will have a $500 college savings account opened in his or her name. A second savings account will also be opened for the parent, who will then have the chance to earn an additional $500 as a match to their own savings and from monetary rewards linked to actions that support the child’s healthy early development. Families will also be given parenting support and coaching in personal finance.

- Kindergarten to College (K2C): When a Brilliant Baby enters Kindergarten, he or she will already have a college savings and high expectations in place. Every other Oakland student entering Kindergarten will have a $100 college savings account opened in his or her name. K2C will provide a match of up to $200 to encourage families to save for their child’s college education.

- Future Centers: Every Oakland high school student will have access to a school-based advising center where they develop college and career plans. These “future centers” will be staffed to help students plan for college and career and support seniors applying for college, financial aid, scholarships, and internships.

- College Scholarships and Completion: Every student who gets accepted into college will have access to college scholarships of $1,000 to $16,000 over the course of his or her college career. Students who attend two-year and technical colleges will receive at least $1,000 per year enrolled while students who attend four-year colleges will receive up to $4,000 per year – depending on the specific arrangement with each college. Additional partnerships will be formed with nonprofits and scholarship providers to provide support to help students graduate.

What made the Oakland Promise exciting to me at last week’s 2016 PromiseNet Conference was how seamlessly it integrated two educational initiatives that have been proven to promote college enrollment and success: college savings accounts and college promise programs. The Oakland Promise was the first to my knowledge to combine the two initiatives – and more – into a comprehensive promise package from the moment a child is born.

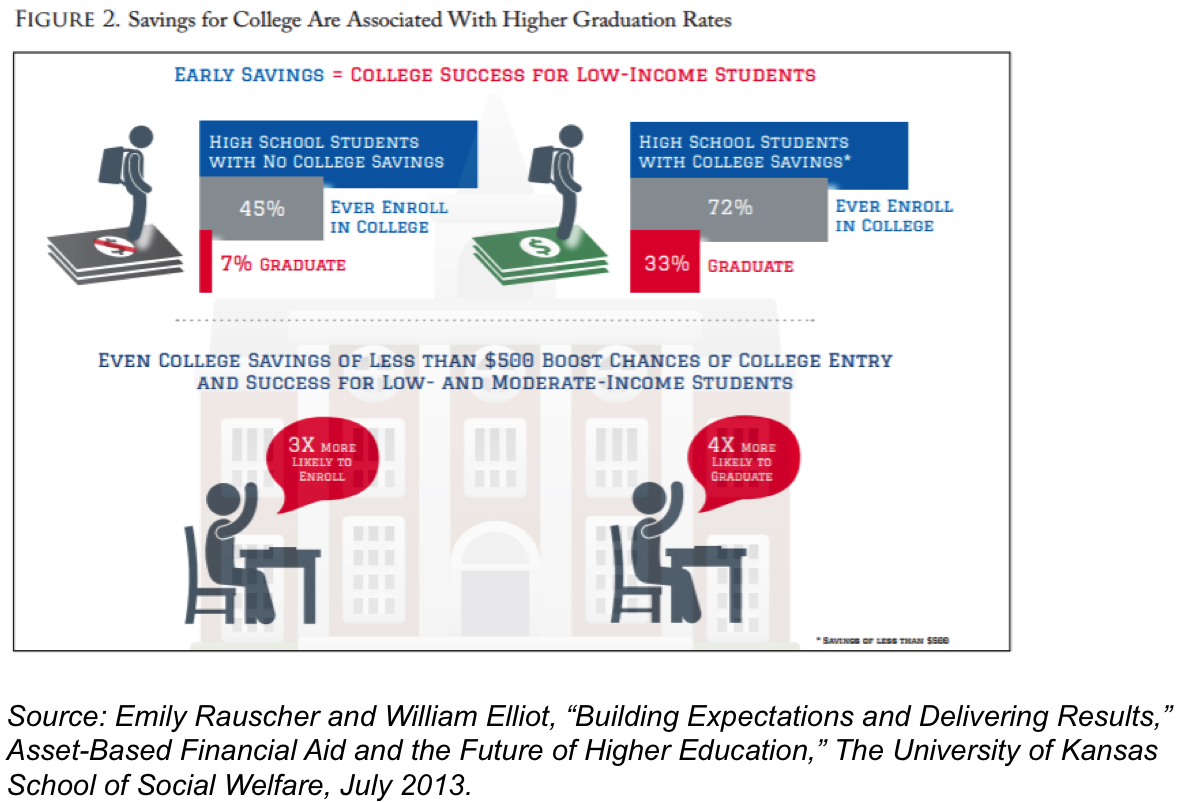

On their own, research has found that college savings accounts improve early childhood development and future financial capability, raises students’ expectations for college, and boosts students’ academic success in middle and high school and college. Most compelling is that a low- to moderate-income or Black student with even $500 or less in savings is three times more likely to enroll in college and four times more likely to graduate than a similar student without savings.

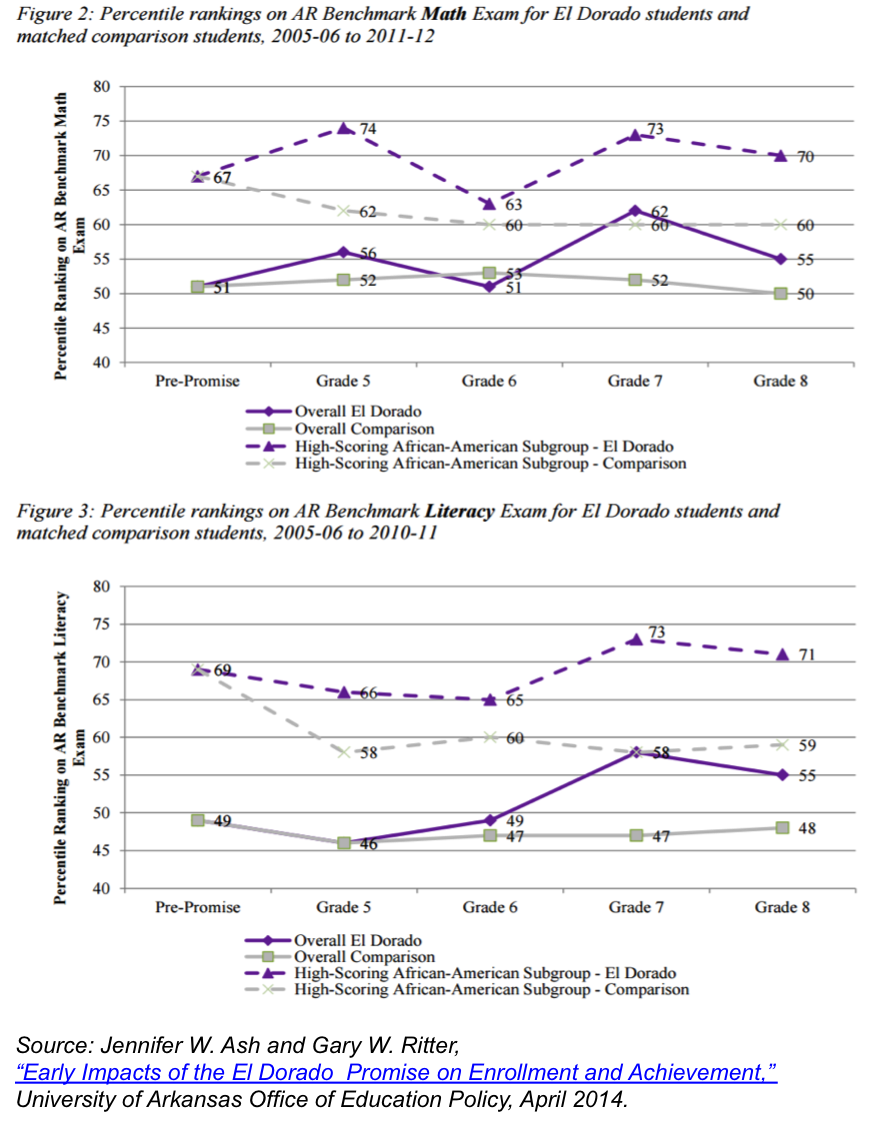

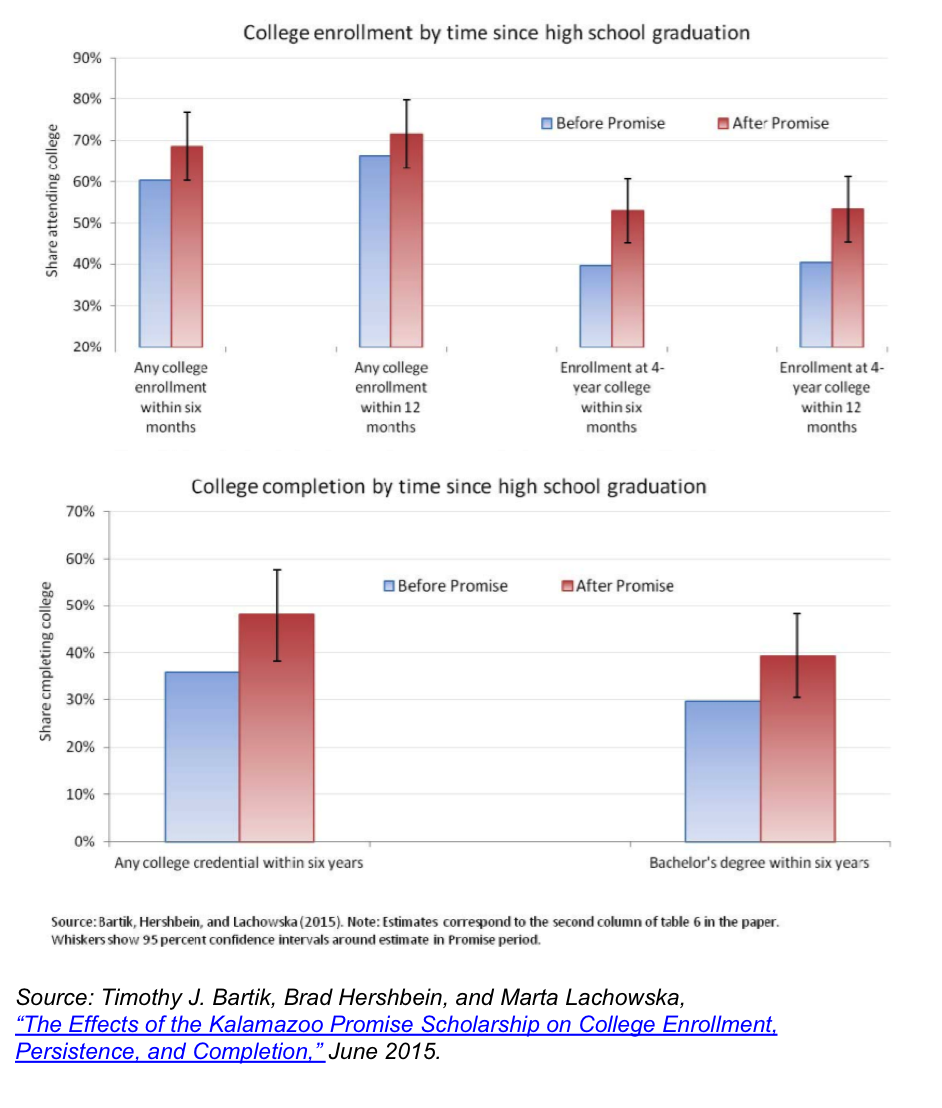

Likewise, overall research on two longstanding universal college promise programs – the Kalamazoo Promise in Michigan and the El Dorado Promise in Arkansas – finds improved K-12 results, spanning from reduced student behavior problems and improved high school GPA for African American students in Kalamazoo and improved math and English literacy test scores in El Dorado, as well as higher college enrollment rates and Bachelor degree attainment rates.

“The opportunity is ripe to connect the two programs,” said Carl Rist from the Council for Economic Development during the 2016 PromiseNet conference, since they have overlapping goals to raise educational expectations and build financial security for college. More importantly, “the weaknesses of one can be overcome by the other,” Rist said. College savings accounts have been proven to promote parental engagement and expectations for their children’s education more than college promise programs.

Moreover, because college savings accounts can help parents and students cover costs not covered by a promise scholarship (most promise programs are limited to offsetting tuition and fee costs only), savings can help foster a sense of “shared responsibility” towards college financing as well as help college promise programs remain financially sustainable over the long run.

At a lunchtime panel, Mayor Chris Cabaldon shared that West Sacramento may be the next city to integrate the two programs in a similar comprehensive approach to Oakland if voters approve a quarter-cent general sales tax increase to, among other initiatives: (1) guarantee universal preschool; (2) establish a college savings account for every Kindergartner, (3) provide free community college tuition, and (4) provide an internship to every high school student. Cabaldon said polls place likelihood of passage at 70 percent.

We hope the voters of West Sacramento will see the value of this effort and that more of these all-encompassing promise programs will soon be on the horizon. Because while a college tuition promise for high-schoolers is appealing, a full cost college promise from Kindergarten (or birth!) is even better.