At the end of 2017, as the GOP tax reform bill was being debated, universities with multi-billion-dollar endowments, such as MIT and Harvard, were aggressively lobbying against taxation on their massive accounts. MIT’s president, Rafael Reif, lamented, “It will reduce MIT’s ability to undertake exactly the kind of activities that Congress wants us to pursue — extensive financial aid for students, innovative education, pioneering research — the same activities that MIT’s alumni and friends have so strongly endorsed for many decades through contributions to our endowment.”

But does MIT live up to its word? Does a thriving endowment lead to growth in financial aid, and with that more access to disadvantaged students? Or, perhaps, lower tuition?

Recently released data illustrates that MIT has the sixth largest endowment in the country, valued at nearly $15 billion. Furthermore, MIT’s endowment grew 11.4% in the past year, and has grown over 45% in the past five years. In fact, the top 25 endowments in the country, worth collectively nearly $300 billion, saw 12.2 percent growth in the past year, and nearly 40% growth in the past five.

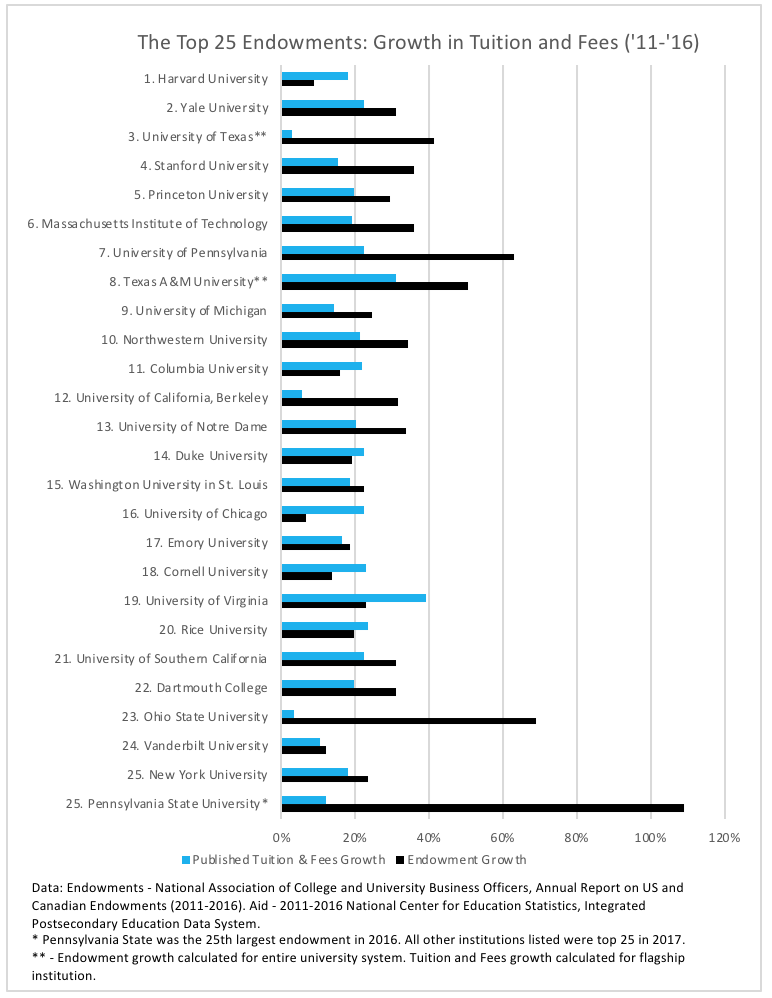

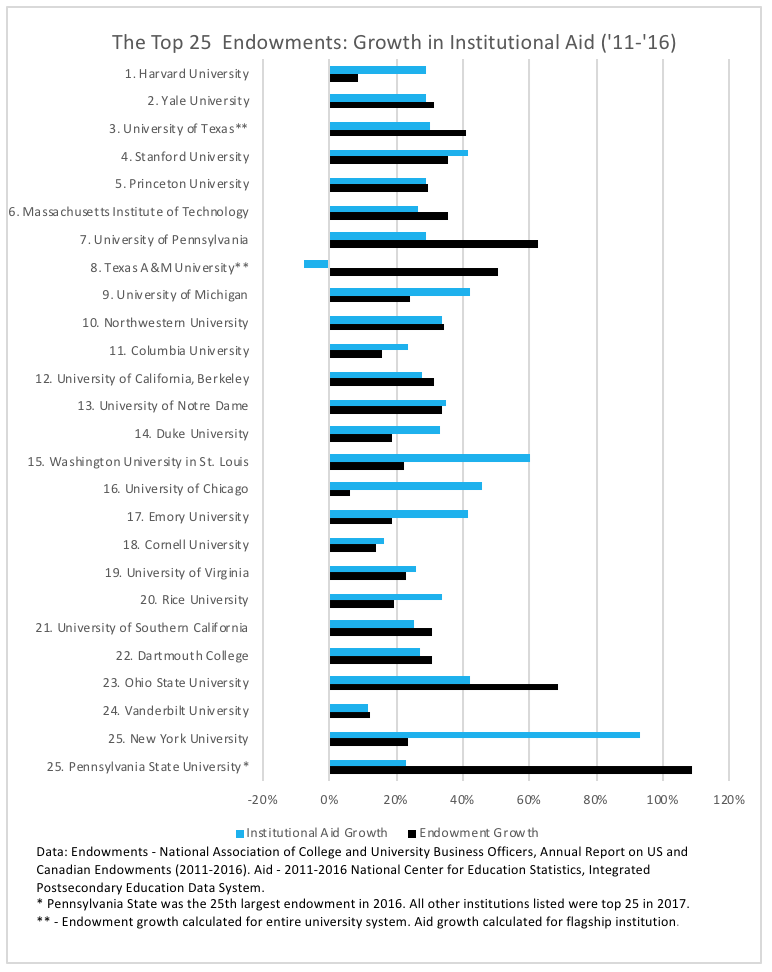

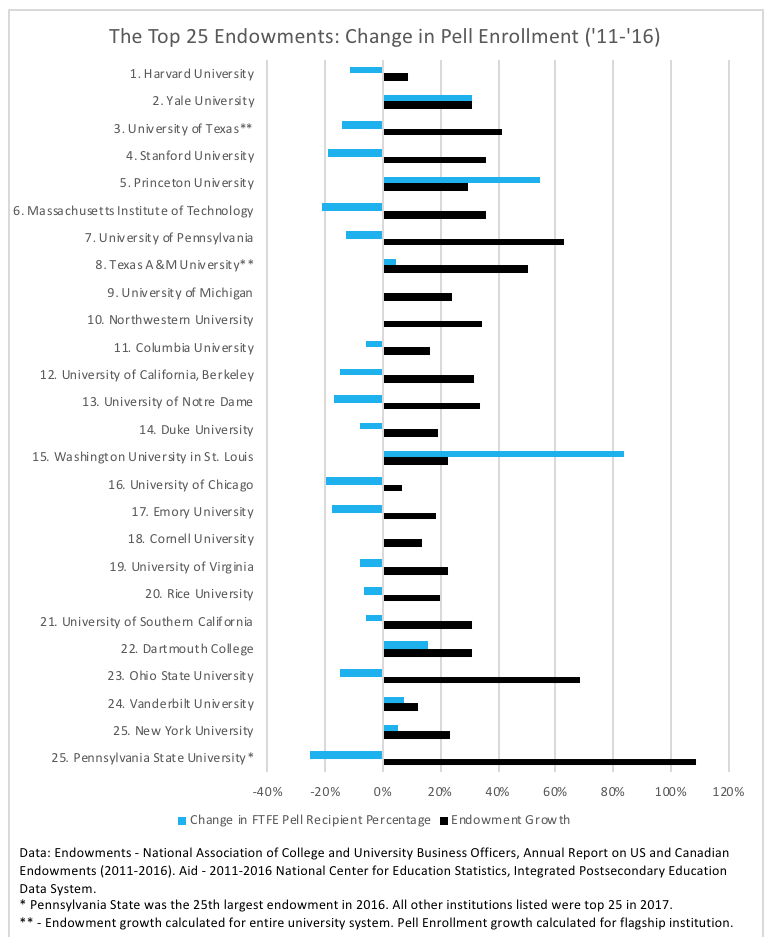

The charts below compare the endowment growth of these institutions relative to the growth in their average institutional aid, growth in their Pell Grant recipient population, and growth in their tuition and fees between 2011 and 2016 (using NCES IPEDS data). Despite meaningful (and often, massive) gains in endowment values at all of these institutions, not a single one of them avoided raising tuition and fees over the past five years.

Furthermore, looking at institutional aid growth, many universities have not kept institutional aid growth at pace with their endowment growth, or with their tuition growth. For instance, the University of Pennsylvania saw endowment growth of over 60 percent in the past five years, raising their hoard up to over $12 billion. At the same time, institutional aid rose less than 30 percent, and that is on top of an over 22 percent increase in tuition and fees. Or, worse, consider the Texas A&M system, where the endowment grew over 50%, but institutional aid at their flagship College Station campus was cut by nearly 8 percent, all while tuition and fees rose by over 30 percent.

With tuition and fees rising at every institution, and only marginal growth in institutional aid at most, perhaps it isn’t surprising that many institutions have seen the proportion of their students receiving Pell Grants decrease by large percentages. 16 of the 26 listed colleges saw drops in the proportion of their students receiving Pell Grants — some by more than 20 percent. Pennsylvania State University, for instance, saw endowment growth of over 100 percent, yet saw a drop in their enrollment of disadvantaged Pell Grant recipients of over well over 20 percent.

This is not to say that all institutions with large endowments are failing to live up to their promise. Washington University in St. Louis dramatically increased institutional aid by over 60 percent, while only raising tuition by less than 20 percent. Stanford raised institutional aid by over 40 percent while keeping tuition increases at around 15 percent. Finally, Princeton kept their institutional aid apace with their endowment growth, while raising the proportion of their student body who are Pell Grant recipients by 55 percent.

For fairness’ sake, MIT is not the worst actor in this space. They increased aid at a rate 6 percentage points higher than the rate at which they raised tuition and fees. On the flip side, they did see an over 20 percent drop in their Pell Enrollment percentage. Still, the indication is clear – some, but not all of these ultra-wealthy institutions are keeping up their end of the bargain.

When non-profit educational institutions were provided tax-exempt status, it was due to the rationale that they provide a public good that the government does not provide, and that any money they save in taxes will be spent on providing that good. It was not given to them so they could become elite, private clubs. If institutions do not want to see their massive endowment chests getting more scrutinized (or taxed), they need to live up to that promise, and use that money to keep tuition low, institutional aid high, and increase access for low-income students – rather than building up a massive hoard of investments designed to simply earn more money.