Under reported are the education implications attached to President Trump’s latest tax reform proposal released yesterday. Included is proposed elimination of the state and local tax deduction that would deeply affect public education funding.

The overall Trump tax plan is getting attention insofar it’s nine times more detailed than his previous release. (Ok, really it’s just nine pages as opposed to his previous one page back of the napkin release.) But it is also getting attention, because Congressional Republicans are desperate to deliver a policy win. In the wake of the health care debacle, tax reform is at the top of their agenda.

Make no mistake that proposed tinkering, if not elimination, of the state and local tax deduction has huge financial implications for education. Moreover, recognize there are parochial, if not partisan, political interests at work.

First, the finances.

Folks tend to think about federal support for education in the form of ESEA and IDEA special education grant programs, but they rarely consider the large role federal tax expenditures, like the state and local property tax deduction, play in subsidizing local school spending. In effect, the state and local property tax deduction makes raising money for public education easier.

Consider an individual in the 28 percent marginal income tax bracket who itemizes and deducts $5,000 in property taxes in turn reduces his or her federal tax bill by $1,400. Of $5,000 raised locally for education, the individual pays $3,600 and the federal government pays $1,400.

Thus the federal deduction for state and local taxes makes using those taxes to fund education and other public goods or services more attractive, because it makes state and local taxes a cheaper source of revenue for regular people than they otherwise would be.

Now the politics.

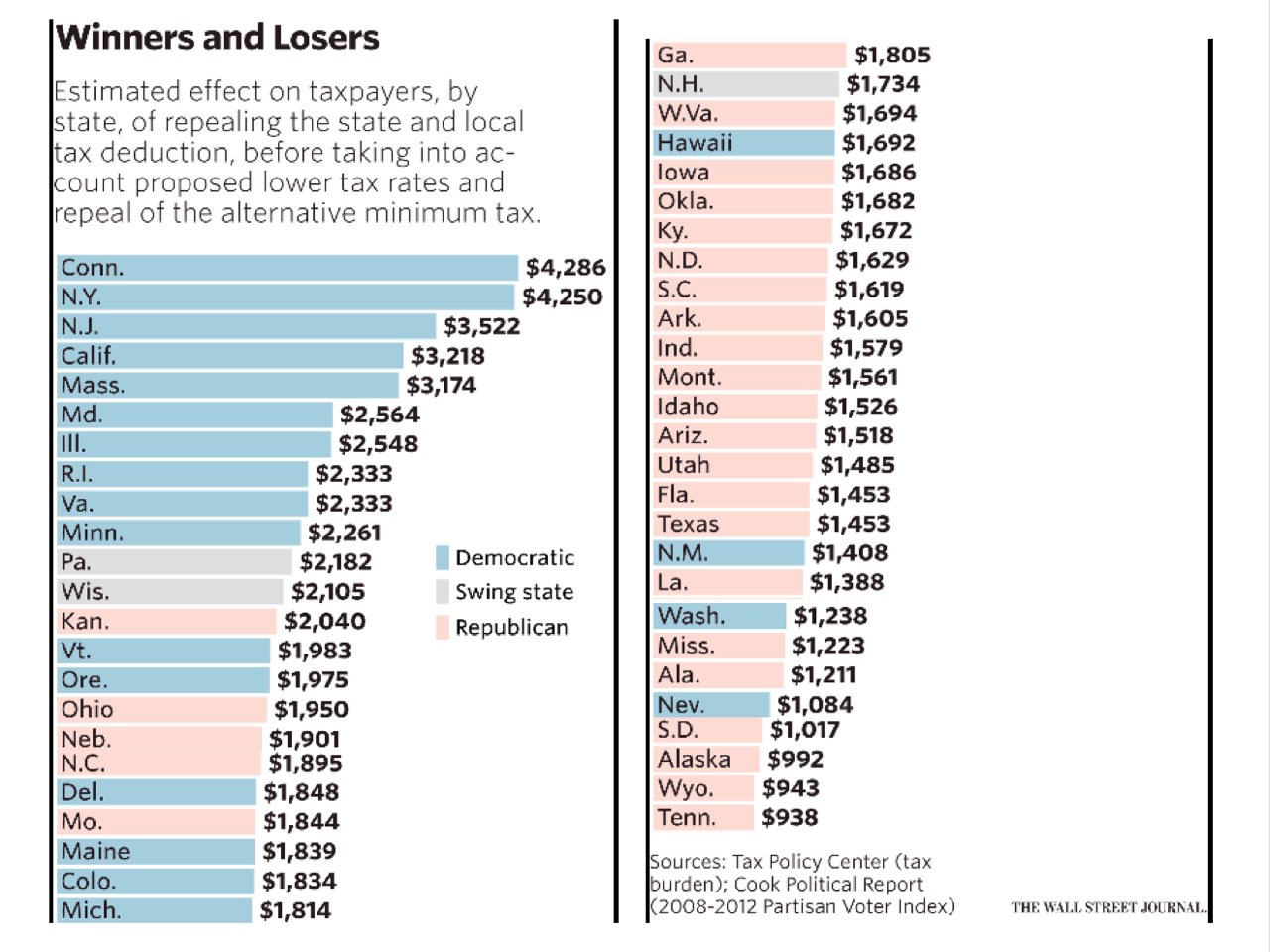

Accordingly, eliminating the state and local tax deduction has been a Republican priority for years. They want smaller government. Now to be fair beyond ideology, there are some legitimate arguments behind the agenda to eliminate the state and local tax deduction. I disagree with them. But let’s not kid ourselves, this is about politics. Take a look at the states that benefit most from the state and local tax deduction. They’re all blue. Blue…blue…blue.

Distribution of the political impact might suggest why it’s not just President Trump who is looking to eliminate the state and local property tax deduction. The House Republican tax committee leadership has advanced the idea repeatedly. In fact, it has been a Republican priority since President Reagan proposed it in 1984. It was defeated back then, but back then there were more ‘blue’ state Congressional Republicans. Those folks are a lot rarer today.

Whatever one’s party, education advocates should resist this latest effort. But those in the resistance also should offer a progressive alternative vision.

Instead of increasing taxes on good things like middle class home ownership and reducing support for public education through the tax code along the way, we should be increasing taxes on bad things like outsourcing and pollution while increasing support for quality public education funding in the process.

In fact, we should do it in a way that promotes equity as well. Increase quality public education funding for everyone, and level up toward equity in the process.

That’s the tax agenda I want to see.

Read Our Plan and Deeper Take First Published in U.S. News & World Report